HABITAT

Queens Co-ops Hit with Bogus Property Tax Bills

Paula Chin in Bricks & Bucks on October 7, 2020

Erroneous back-tax bills totaling $1.3 million were a shocker to three Queens co-ops.

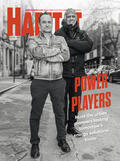

Geoffrey Mazel had a massive problem on his hands. Mazel, a partner at the law firm Hankin & Mazel, represents three co-ops in Queens that had been hit, in rapid succession, with erroneous bills from the Department of Finance (DOF) for being in arrears on their property tax payments. How staggering were the three tax bills? They totaled $1.3 million.

The nightmare began in September 2019, when Mazel was meeting with the board at Bell Park Gardens, an 800-unit co-op in Bayside, and he learned that the co-op had just been served a $625,000 bill for unpaid taxes in 2017. “The DOF wasn’t offering a payment plan and wanted us to pay up by October or else incur a 9% interest charge,” recalls treasurer Mark Ulrich, a certified public accountant and professor of accounting at Queensborough Community College. “We were in a panic.”

Mazel had to move swiftly. “I immediately contacted the offices of our local council member, Barry Grodenchik, and established a direct line to the DOF through them,” he says. “They dug in and started an investigation.” But no sooner had Mazel made the call than he learned that two other clients had been hit with erroneous bills for the same period: the 800-unit Beech Hills co-op in Douglaston for $180,000, and the 3,000-unit Glen Oaks Village in Glen Oaks for $600,000.

“We pay our property taxes on time and in full,” says Glen Oaks president Bob Friedrich. “I’d heard about Bell Park, and realized it was the same type of error. Something was clearly going awry with the DOF’s calculations.”

The enormous bill aside, the DOF’s mistake had a ripple effect on the co-op’s finances, Friedrich adds. “We have a mortgage with National Cooperative Bank, which was asking us why we weren’t paying our taxes. And people who were applying to purchase units were being told the same thing.”

It took many months, but Mazel and Grodenchik eventually got to the root of the problem. “We had a conference with the DOF business review unit, and apparently they had inadvertently removed certain J-51 tax abatements for apartment renovations,” Mazel explains. “Also, the state passed a law in 2017 capping the STAR school tax relief, but their computer calculations for exemptions on co-ops weren’t correct, and certain blocks lost their STAR credits.”

As a result, the DOF agreed to reverse the overcharges for all three co-ops. But that’s not the end of the story. “I can’t explain exactly what went wrong,” Mazel says, “but it happened only in multi-lot properties, and I think it may be a pervasive problem. I suspect there are other large co-ops that have gotten these charges – maybe in smaller amounts like $5,000 or $10,000, which would be easy to overlook or even ignore. Taxes are treacherous and hard to figure out, and co-ops could be intimidated into paying just to avoid the exorbitant interest.”

Mazel has a clear message for boards: Read your tax bills carefully, don’t assume they are correct, and if they don’t seem right, contact your elected officials. Grodenchik, the city council member, adds: “At a time when so many New Yorkers are out of work and the pandemic continues to pressure household budgets, inflated property tax bills are a burden that few can afford. I asked the city finance department to address its billing errors as quickly as possible, and in most cases, that has been done.”

Mazel concurs: “At the end of the day, the system worked and good government prevailed. We had a happy ending.”